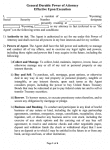

Wyoming Limited Power of Attorney Form for Excise Tax is pursuant to the Title 39 – Taxation and Revenue of 2015 Wyoming Code and allows you to grant powers to an agent to represent you before Wyoming Excise Tax Department for the tax affairs specified in this legal instrument. Please file duly filled and signature notarized original power of attorney in the Excise Tax Division of the Wyoming Department of Revenue at Cheyenne, WY 82002-0110. You may sign and execute another limited power of attorney to extend or restrict the scope of tax affairs in case you need so later. Similarly, you may decide to add another agent/representative by issuing a new power of attorney. Notarization of your signature and identity is mandatory for filing and recording this power of attorney before the Wyoming Excise Tax Department.

Wyoming Limited Power of Attorney Form for Excise Tax Facts

- Please mention the tax type, nature of the requested document, and period of tax affair accurately. Use a separate line to grant powers to the agent/representative to stand for you before Wyoming Excise Tax Department for each tax type.

- Corporation Major Officer; Individual Business c Owner; LLC or LLP Member or Manager; and Partnership Partner are authorized to sign and execute Wyoming Limited Power of Attorney Form for Excise Tax on behalf of the taxpayer under penalty of perjury.

- You must get this power of attorney acknowledged from competent notary public of Wyoming State for its legal standing and processing at the Department of Revenue of Wyoming State.

- You may choose CPA, attorney, or a bookkeeper to account for you before the Wyoming Excise Tax Department.

Directions for Filing a Power of Attorney for Excise Tax in Wyoming

Step 1: Enter your Sales/Use Tax License Number, Revenue Identification Number, Taxpayer\s Name, and Mailing Address on the respective lines of Wyoming Limited Power of Attorney Form for Excise Tax.

Step 2: Enter the legal name of the agent on the next line. Then mention the tax type, nature of the requested document, and tax period. Use separate line for entering each tax type if more than one.

Step 3: You must sign before a notary public of Wyoming State after entering the name of the authority, title, phone number, and date on the respective lines.

Step 4: Please request the notary public to acknowledge your signature and identity by filling the necessary details along with the seal and the signature.

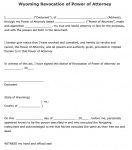

Revoking the Wyoming Power of Attorney for Excise Tax

This Wyoming Limited Power of Attorney Form for Excise Tax remains in force forever unless revoked by issuing a revocation instrument. You must file this revocation instrument before the Department of Excise Tax, Wyoming. However, Title 39 – Taxation and Revenue of 2015 Wyoming Code permits you to issue another power of attorney to amend excise tax affairs and add a new agent if you wish to appoint so.